The expansion of the life sciences industry in New York City has crowned the metro area as the largest life sciences hub in the country. According to a report released by the Department of City Planning (DCP) and the New York Economic Development Corporation (NYCEDC), NYC now leads the way in jobs and funding.

Despite an industry slowdown in 2023, New York’s life sciences real estate community is optimistic the industry will see significant growth in 2024. To learn more about what is coming down the pike, we sat down with Bill Harvey, industry veteran and executive vice president at JLL, to gain his insight on what the future holds for NYC’s life sciences sector.

Outpacing other U.S. regions

When it comes to the growth of the life sciences sector, Harvey said New York City currently has more than four million square feet of lab space. In 2021 and 2022 alone, life sciences leasing in the city reached above 400,000 square feet each successive year. With this accelerated growth, by today’s standard, the metro area is considered a powerhouse, having generated over $23 billion in wages last year. With nearly 150,000 jobs and 5,100 businesses, NYC is outpacing San Francisco and Boston in these respective areas. “It’s a great time to be in the business,” said Harvey. “I’m incredibly optimistic about life sciences going forward, especially in New York City.”

How it all started...

With decades of experience in real estate, Harvey truly made his mark in the industry by having brokered some of the most lucrative and impactful transactions in the life sciences real estate sector. After earning his master’s degree in real estate development from Columbia University’s Graduate School of Architecture, Planning and Preservation nearly 25 years ago, he has forged a lifelong path of success since the beginning his career as a project manager at the New York City Economic Development Corporation (EDC). Over the next decade, he worked extensively in multi-use redevelopment and commercial real estate. Then, in 2009, Harvey joined Newmark, a commercial real estate advisory firm in NYC where he represented a wide range of high-profile clients.

While at Newmark, his career not only inadvertently switched lanes into the life sciences real estate market, but it was also where he met Gus Mazza, the current executive vice president of life sciences at Milrose Consultants. “In 2011, we began working together on the New York Genome Center transaction. At that time, New York City did not have a life science sector to speak of. A year-and-a-half later, in 2012, we closed the deal, which turned out to be one of the largest transactions of the year—175,000 square feet of space at 101 Avenue of the Americas. I suppose you can say that was the first deal to set me down this path.”

The Team on Speed Dial

Looking back almost 13 years since Genome, Harvey said many of the people who were on that team are still those he leans on today.

“It’s a small list of consultants, brokers, architects, engineers, and others that have real deal-making experience.

Among his team members on the New York Genome Center project were Yasmeen Pattie of East Egg Project Management, Chris Hoch and Mitch Simpler of JB&B, Brian Aronne of Hunter Roberts, and Steve Szycher of Thornton Thomasetti. “These are the kind of people I have on speed dial,” he said. “It’s a small list of consultants, brokers, architects, engineers, and others that have real deal-making experience. I think of it as a ‘big city, small town,’ if you will.”

Little did the Genome team know it would be a couple of years before the next life sciences deal came along. “We were all convinced at that time that the next deal was around the corner,” Harvey explained. “It wasn’t until 2015 when the New York Stem Cell Foundation made a deal at Hudson Research Center. It was that deal that jump-started interest in the life sciences sector again.”

NYC’s Path to Global Leader in Life Sciences

In 2016, the New York City Economic Development Council (NYCEDC) launched LifeSci NYC, a 10-year $500 million investment into growing the City’s life sciences sector. Shortly after, the State of New York launched their own $620 million initiative to spur the growth of New York State’s life sciences industry by providing tax incentives and grants to those who invest in life sciences development projects.

The City and State investments paid off as many leading life science companies began opening facilities in New York City. A key project that helped bolster NYC's life sciences community was King Street's Innolabs—a 270,000 square foot state-of-the-art life sciences complex located at 45-18 Court Square W in Long Island City.

In late 2016, Harvey was introduced to King Street, a Boston-based national leader in life sciences real estate development. “I believe King Street’s move to New York was instrumental for the city’s life sciences market,” he stated. “As a best-in-class operator and developer from outside of our market, they showed serious interest in coming to New York and building on spec. There’s a big difference between building on spec and waiting for a tenant. It showed a certain level of conviction that other developers just don’t have.”

Harvey helped introduce King Street to its partner at Innolabs, GFP Real Estate, and the facility opened its doors in 2022. Harvey provided an update on the status of the new LIC life sciences hub stating, “Currently, we are at 75 percent occupancy, which is something that speaks to the development team’s expertise. "I believe Long Island City will be one of the pre-eminent clusters for life sciences in New York City."

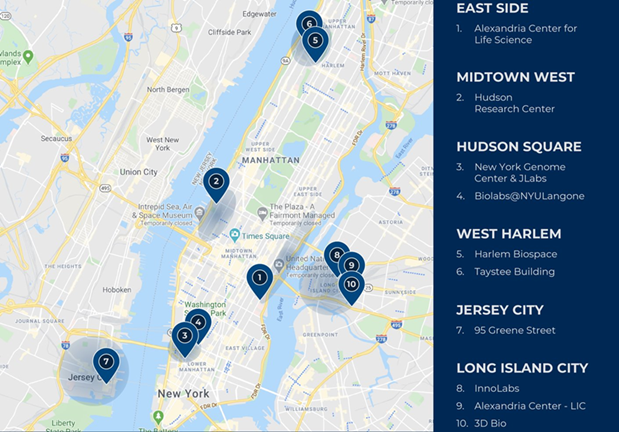

Map of NYC’s Life Sciences Subclusters:

Key Ingredients to a Successful Life Sciences Cluster

Harvey explained that for a life sciences market to thrive and become a successful cluster, there are three key ingredients that are necessary. These ingredients work together to create an ecosystem that fosters innovation, collaboration, and growth in the industry. Let's take a closer look at each of these ingredients:

- Academic Medical Hospitals and Universities

One of the crucial factors that contribute to the success of a life sciences market is its proximity to top-ranked research universities. These institutions serve as hubs of cutting-edge research, medical advancements, and scientific expertise. Having close proximity to these institutions creates opportunities for knowledge exchange, talent acquisition, and partnerships that drive innovation and growth. - Pharmaceutical Companies

The presence of pharmaceutical companies is another vital ingredient for a booming life sciences market. These companies play a crucial role in the development and commercialization of new drugs, therapies, and medical technologies. They bring not only financial investment but also expertise in drug discovery, clinical trials, manufacturing, and distribution. Pharmaceutical companies can fuel the growth of life science communities by providing resources, funding, and collaboration opportunities for startups, research institutions, and early-stage companies. - Early-Stage Companies

Startup biotech companies help attract attention and drive investment in the life sciences sector. These companies are often at the forefront of innovation, pushing the boundaries of scientific discovery and technological advancements. Close proximity to academic institutions, funding, and a network of mentors, advisors, and investors is key to their success.

Opportunity for Developers

I believe this new legislation will do a lot to advance the city’s interest in bringing low-cost lab space to end users.

In NYC's rapidly growing life sciences hub, an influx of incubation space for young biotech companies has become available on the market. "There's no shortage of scientific incubation space in New York City" says Harvey. The problem many early-stage biotech companies are now facing is the need for more space as they outgrow their current facilities. When a company surpasses the size limitations of an incubator or small-scale laboratory but lacks the financial resources to sign a long-term lease for a larger space, they need what Harvey refers to as "graduation space".

"What I call graduation space is that middle ground, anywhere between 3,000 to 4,000 square feet on the low side to 8,000 to 10,000 square feet on the high side," explains Harvey.

This presents an opportunity for developers in the life sciences real estate market. To accommodate the needs of these growing companies, developers can construct buildings with labs that range in size to allow companies to easily relocate floors within the same building, rather than relocate entirely, when they outgrow their current space. Additionally, developers can capitalize on this opportunity by incorporating shared scientific and building amenities within these buildings. By providing shared amenities such as conference rooms, kitchenettes, collaborative spaces, advanced laboratory equipment, autoclaves, and event programming, developers can offer added value to their tenants.

Coming full circle: Joining the NYCEDC Real Estate Life Sciences Advisory Board

Last year, Harvey was appointed to New York Mayor Eric Adams’ Real Estate Life Sciences Advisory Board. “Going back almost 25 years—when I was a student in their master’s program and landed my first job there—I feel like I’ve come full circle.” he said humbly. “Both the city and state have been responsible for much of the growth we’ve seen in the sector over the past five-to-ten years.” He said the latest legislation signed into law by Mayor Adams offers tax incentives that enable growing biotech companies to create jobs in NYC. “I believe this new legislation will do a lot to advance the city’s interest in bringing low-cost lab space to end users,” he explained. “As a former economic development professional, it’s incredibly gratifying to see the growth of lab space created in Manhattan and the surrounding boroughs.”

Harvey joined JLL last May as the company’s executive vice president, where he focuses on landlord and tenant representation in the New York metropolitan area—with a specialization in biotech/life science real estate. When asked about the benefits of working with an experienced expediter and code consultant for life sciences projects he replied: “Having a group like Milrose Consultants is invaluable to any development team, especially ones that may be out of state. New York is a unique market. Having a company like Milrose advocating for you is the best money a developer can spend.”

Looking to the future, Harvey said, “Life sciences in New York is still a very new industry. I believe we still have the ability to shape where this is going. That really excites me.”

If you are looking to convert or build new lab space in New York City, Milrose is highly qualified to guide you through NYC's complex permit approval process. Contact us today to learn how we can help bring your next life sciences project to life.

-2.png)

-2.png)

-3.png)